Should I Opt-Out of PIP Coverage if I Have Medicare or Medicaid?

Medicare Recipients and the Auto No-Fault Opt-Out Option

Seniors can now opt-out of no-fault PIP expense benefits if they:

- are covered under both Parts A and B of Medicare; and

- their spouse and any resident relative has Medicare “qualified health coverage” or has coverage under a separate no-fault policy.

Furthermore, Medicare recipients injured in a motor vehicle accident who opt out of no-fault PIP benefits will not be able to receive any no-fault coverage through the Assigned Claims Plan. However, they may be entitled to Assigned Claims Plan (ACP) coverage if injured in a collision as a non-occupant or pedestrian. Coverage under the ACP capped at a maximum $250,000 of benefits.

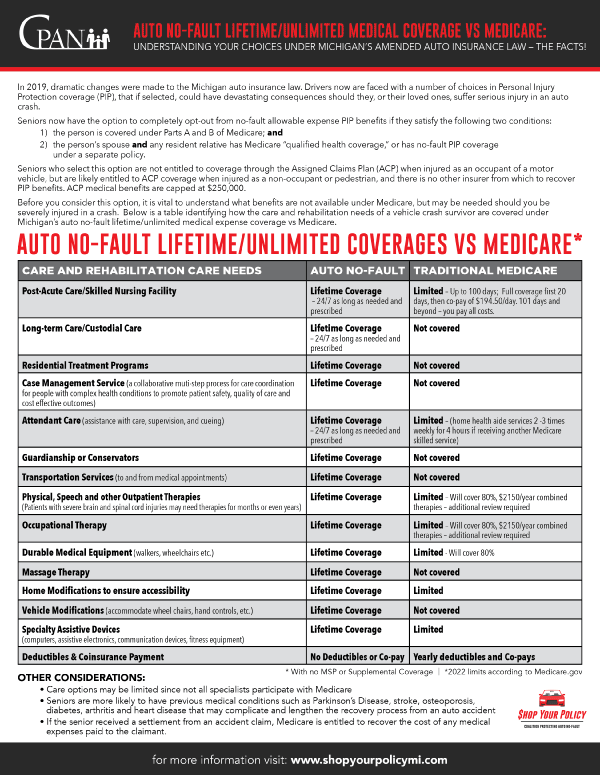

Does Medicare Cover Auto Injuries Under the New Law?

The Coalition Protecting Auto No-Fault (CPAN) has created a tremendous summary document that compares and contrasts the difference between no-fault and Medicare coverage regarding the care, recovery, and rehabilitation of people with auto accident-related injuries. Understanding which services and specialties are not covered under Medicare, or are covered only up to a certain limit, is absolutely vital to persons who are considering to opt-out.

Please visit CPAN’s website to view and download this valuable, free PDF. You can also go to ShopYourPolicyMI.com about shopping for your auto insurance policy under the new law.

Medicaid Recipients and the $50,000 PIP Option

Under the new auto no-fault law, recipients of Medicaid can select a $50,000 PIP medical expense option. This option is only available if:

- the named insured is enrolled in Medicaid; and

- their spouse and resident-relatives are also covered under Medicaid, are covered under a qualified health insurance plan, or have PIP coverage under a separate auto insurance policy.

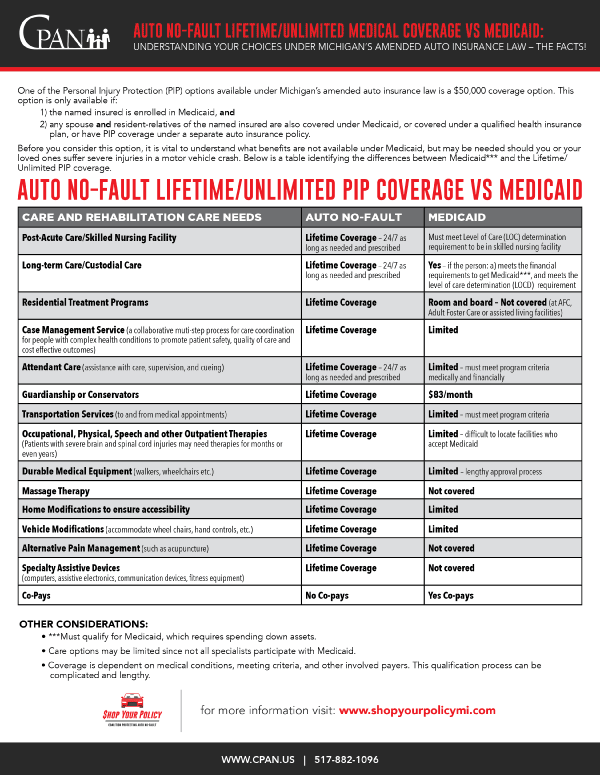

Does Medicaid Cover Auto Accident Injuries Under the New Law?

If you are considering opting for this level of PIP coverage, it is absolutely crucial you first understand which services are not available through Medicaid but may be needed in the event of an auto accident. Again, CPAN has created a remarkable brochure for consumers to compare coverages.

Please visit CPAN’s website to view and download this valuable, free PDF.

Should I Opt-Out of PIP Coverage?

If you’re still wondering “should I opt-out of PIP coverage” we strongly advise against doing so. Medicare and Medicaid both offer very limited services in terms of the scope of care available for people seriously injured in motor vehicle accidents. Michigan’s unlimited, lifetime auto no-fault system is still the most robust coverage in the event of an accident. In fact, for the best protection for you and your family, we recommend purchasing the following insurance coverages:

1. Unlimited, lifetime no-fault coverage

2. Significant amounts of liability coverage

3. Significant amounts of underinsured and uninsured motorist coverages

4. Avoid managed care plans

5. Avoid step-down policies

Read our recent article outlining each of these coverages and why they’re so important here: Sinas Dramis auto insurance coverage recommendations under the new no-fault law.

RELATED READING

How Medicaid Affects a Personal Injury Case

What is Michigan’s no-fault allowable expense benefit?

What do consumers need to know about Michigan’s new no-fault coverage options?

What if I receive government benefits for my auto accident injuries?