Michigan Auto Insurance Changes – What Buyers Need to Know

Join Grand Rapids auto accident attorney, Tom Sinas, in this Fox 17 “Know the Law” special series highlighting the Michigan auto insurance changes and new purchasing decisions.

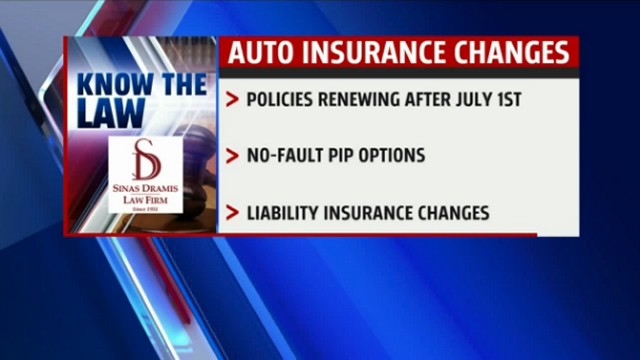

By now, almost everyone in Michigan knows that our state’s auto insurance law was reformed last year. The reform introduced vast and sweeping changes to the system as we know it. Many of those changes, however, haven’t impacted consumers yet, but are about to do so. For auto insurance policies renewing after July 1, 2020, consumers will need to make these new purchasing decisions.

In the weeks ahead, Tom Sinas will cover many of the significant Michigan auto insurance changes and consumer purchasing options.

Part 1 – Tom provides an introduction to auto no-fault coverage and liability coverage. Understanding these two coverages is the foundation you need to make an informed decision about your new auto insurance options.

Part 2 – Tom covers new consumer PIP choice options under the reformed no-fault law.

Part 3 – Tom discusses the different PIP choices for certain consumers who also qualify for Medicare, Medicaid, or health insurance that covers auto-related injuries, as well as the associated risks of choosing these options.

Part 4 – Tom talks about the shift toward increased liability for all Michigan drivers under the new law and explains the need to purchase as much liability coverage as possible.

Part 1 – Introduction to Auto No-Fault and Liability Coverage

Auto No-Fault Coverage

At its core, auto no-fault insurance is the coverage consumers purchase to take care of their medical needs after an automobile accident. Dating back to the 1970s and the enactment of the Michigan Auto No-Fault Act, everyone entitled to no-fault benefits had uncapped no-fault coverage, until now. This uncapped no-fault coverage wasn’t limited in time or by dollar amount. This meant that, up until now, anyone injured in a motor vehicle accident and who was entitled to no-fault benefits could access whatever necessary and reasonable care, rehabilitation, and recovery treatment and resources they needed to recover, paid for by their no-fault PIP benefits.

Many of the new no-fault policies people will have to choose from will limit that amount of no-fault coverage.

Liability Coverage

Liability insurance is the coverage you purchase to protect yourself financially if you cause a car crash hurting someone else. Under the new law, people will also have to choose liability coverage limit options. These liability insurance options are all the more important now because, for the first time since the early 1970s, at-fault drivers can be held responsible for a victim’s medical expenses.

Part 2 – PIP Choice Options

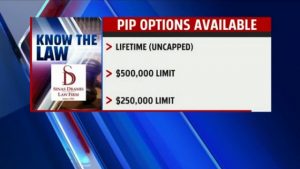

In the second installment of this “Know the Law” mini-series, Tom talks about the new PIP choice options under the new auto insurance law. For the first time since the 1970s, Michigan consumers aren’t guaranteed lifetime coverage for medical and rehabilitation expenses and must choose the level of coverage they want.

The following levels of coverage are available to every consumer in Michigan:

- Lifetime (Uncapped) PIP Benefits- Consumers can still opt for the same level of coverage that was offered under the original Auto No-Fault Act.

- $500,000 PIP Benefits – Caps injured auto accident victims at $500,000 in medical and rehabilitation expenses.

- $250,000 PIP Benefits – Caps injured auto accident victims at $250,000 in medical and rehabilitation expenses.

Part 3 – Other PIP Choice Options

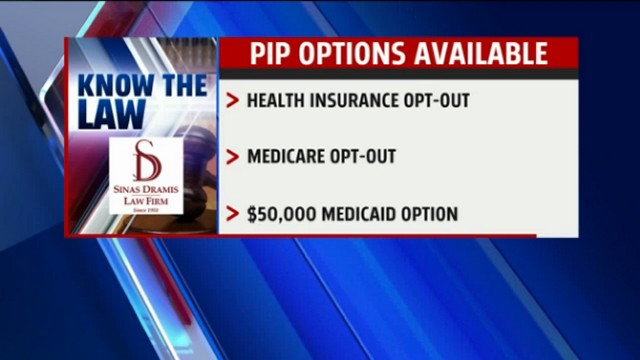

While the second installment of this series discussed two choices available to all consumers, the third installment discusses choices available only to certain consumers. Qualifying for these three options is dependent on a person’s eligibility for other forms of health insurance. The levels of coverage available for these select consumers under the new auto no-fault law include:

- Health Insurance Opt-Out – Those with health insurance that includes coverage for auto accident injuries can opt-out of no-fault insurance coverage completely.

- Medicare Opt-Out – Individuals that are enrolled in the Medicare program can opt out of no-fault insurance coverage completely.

- $50,000 Medicaid Option – Consumers with a Medicaid policy may choose to have this level of coverage, after which they will be reliant on Medicaid if they exhaust that limit. Read more about Medicaid and personal injury claims here.

These options come with a higher risk than other options if chosen. In the case of an accident, consumers under one of these options will have to rely on other forms of health coverage, or limited amounts of PIP coverage if the consumer chose the Medicaid opt-out. Generally speaking, the auto no-fault system covers a broader spectrum of benefits and services to auto accident victims than any of these other forms of health insurance.

Part 4 – Increased Liability and Financial Exposure Under New Law

Your liability coverage protects you financially in the unfortunate event you cause an auto accident and injure someone else. Under the new auto no-fault law, the minimum amount of liability insurance a person is required to carry is $250,000 per person, not to exceed $500,000 per accident. This is a significant increase, up from the minimum $20,000 per person, $40,000 per accident that has been unchanged for many decades. However, a provision of the new law allows people to opt-out of this default minimum and lower their liability coverage down to $50,000 per person/$100,000 per accident, which is woefully insufficient due to an increased liability for all drivers under the new no-fault law.

As you’ll recall from previous segments, Michigan consumers can now choose capped policy limits on their no-fault coverage. This means people injured in motor vehicle accidents can now pursue excess medical costs from the driver who caused the accident. Due to this shift in risk, drivers should consider purchasing as much liability insurance as possible to protect themselves financially in the event of an accident.

As mentioned in both segments, our firm has created “Making Smart Choices: A Summary Guide to the NewAuto No-Fault Law.” In this brochure, which is freely accessible to all, we dive deeper into these PIP choice options and offer our best advice for choosing the safest level of PIP coverage for you and your family. Please feel free to read it, share it with your friends and family, and use it as a resource in the weeks and months ahead to educate yourself on your new auto insurance options.

Please stay tuned as we update this page with upcoming segments on this very important and timely topic!

RELATED INFORMATION

- “Making Smart Choices: A Summary Guide to the New Auto No-Fault Law“

- Fox 17 “Know the Law” segments

- A look at the new auto no-fault legislation