Understanding an Auto Insurance Declaration Sheet and Your Coverage

Following the 2019 Michigan auto no-fault reform, the decisions drivers must make when they select their auto insurance coverage are now more important than they ever has been before in Michigan. In a recent episode of “In the Name of the Law” featuring Lansing auto accident attorney, Stephen Sinas, he breaks it down and highlights the importance of understanding an auto insurance declaration sheet.

Understanding an Auto Insurance Declaration Sheet

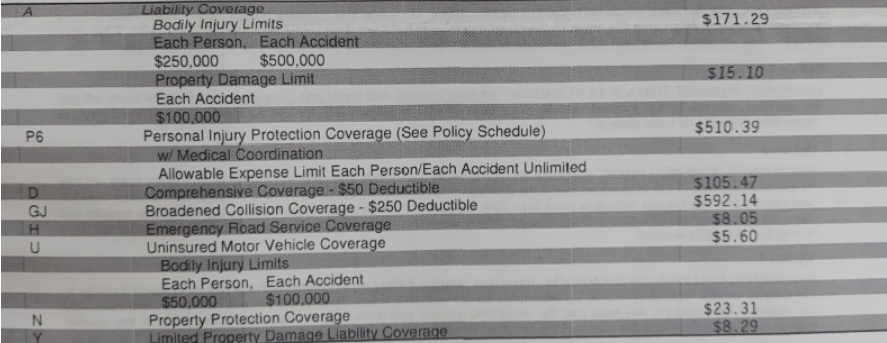

Looking at this example referenced by Steve in the episode, you can see what this policy covers for personal injury protection (PIP) benefits, uninsured motorist coverage, and underinsured motor vehicle coverage, and more.

Understanding an Auto Insurance Declaration Sheet: Personal Injury Protection (PIP)

Line P6 is where we find Personal Injury Protection (PIP) benefits, meaning in the event of a serious crash, the coverage of:

- Medical expenses

- In-home attendant care

- Barrier-free residential accommodations

- Vocational rehabilitation

- Special transportation

- Medical mileage

- Guardian/Conservatorship expenses

- Services of an independent case manager

A subsection of that line shows unlimited medical expenses. This means under the new auto no-fault law, the policyholder selected unlimited, uncapped no-fault coverage, and their medical bills will be fully covered. While Sinas Dramis recommends this coverage for all motorists, you can pay a lower premium for lower coverage options. But please note: should you suffer catastrophic injuries in a crash, your medical expenses will only be covered by your policy up to that selected limit. We provide free digital and in-print resources to better understand no-fault PIP benefits, which can be requested by clicking here.

Another line under the PIP section deals with coordinated and uncoordinated benefits. This means, if your policy is coordinated, like the one in the example above, you must first go to your health insurance, before receiving coverage under your auto policy. If you have uncoordinated coverage, you go right to auto insurance to receive auto no-fault PIP benefits. In our opinion and having dealt with thousands of auto claims and insurance policies over the years, uncoordinated coverage is the way to go. Instead of dealing with the headache of two insurance trying to determine who pays what, with an uncoordinated policy you will only be dealing directly with your auto insurance provider which seems to save a lot of people hassle.

Understanding an Auto Insurance Declaration Sheet: Liability Insurance

Liability insurance is now more important than ever for Michigan motorists under the new law, as everyone is at a higher risk of being sued in the event of a Michigan motor vehicle crash. In this policy, Line A, the insured has made the decision to purchase $250K per person/ $500K per accident in liability coverage. Meaning if they caused the crash, and they get sued, they’re covered for that amount of money.

Prior to 2019, liability risk was lower, and while at-fault drivers could be sued for pain and suffering, everyone still had unlimited coverage under their own PIP benefits. Now that’s not the case. In the event of a crash, a personal injury attorney may help their client pursue a liability claim against the driver who caused the crash that resulted in their injuries to help them receive more monetary compensation to help them recover from their injuries that aren’t covered under their no-fault benefits if they chose less than an unlimited auto insurance policy. Under the law, the coverage selection we see in our example is the default amount of liability insurance motorists must carry, unless they fill out what is called a liability waiver and meet a standard of requirements. In those cases, motorists can select a lower limit but not less than $50,000 per person/$100,000 per accident.

Understanding an Auto Insurance Declaration Sheet: Underinsured/Uninsured Motorist Coverage (UIM)

Line U: This coverage pays you for damages caused by a driver at fault, that doesn’t have enough liability insurance to fully help you recover. Underinsured/Uninsured Motorist Coverage is optional when choosing your coverage. In our example, we see that this policy includes $50K per person/ $100k per occurrence. It’s suggested that not only do you purchase this insurance but that you purchase a large policy.

Understanding an Auto Insurance Declaration Sheet: Limited Property Damage

Line Y: If you’re involved in a crash that wasn’t your fault, you have a limited right to sue an at-fault driver for the damage caused to your vehicle. Under Michigan’s old auto law, that right was limited to $1,000. Now that amount is limited to $3,000. So in turn, if you caused the crash, this is your coverage if someone sues for vehicle damages.

Understanding an Auto Insurance Declaration Sheet: Comprehensive/Broad Form Collision

Line D: This is your own coverage for the damage caused to your vehicle. As there is a limit to what you can sue for, it’s suggested you purchase this coverage to help cover the remaining damages not recovered in a crash from an at-fault driver, or if you can’t sue because you caused the crash.

Understanding an Auto Insurance Declaration Sheet: Property Protection Insurance

Line N: In the event you’re involved in a crash and you leave the road and damage a building or property, this is the coverage your insurance must pay to assist with repairs.