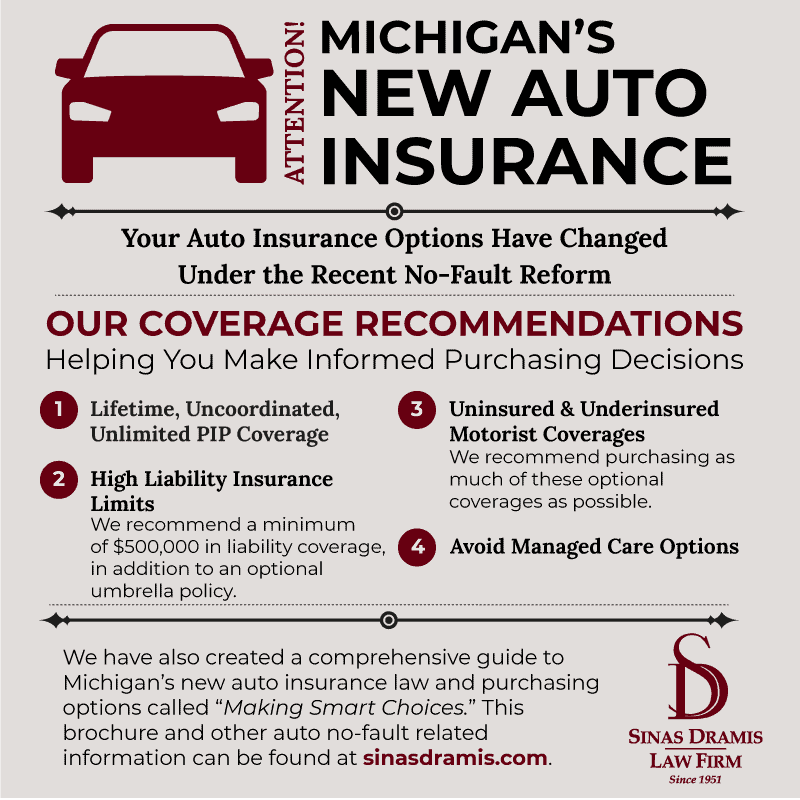

Recommended Michigan Car Insurance and the New No-Fault Law

Michigan’s new auto no-fault law is now in full effect, and many new car insurance options are available for consumers to purchase for the first time since the 1970s. The choices many people will make in response to the new auto insurance law will be dictated by the harsh economic reality of cost. People can only buy what they can afford. However, buying less than what is affordable will only invite disaster if the policyholder suffers a catastrophic injury that exceeds the selected no-fault PIP coverage levels or causes another person to suffer such an injury. As a law firm handling hundreds of auto accident cases year after year, we’ve seen firsthand how important car insurance is in the event of these catastrophic events. We have pored over the new auto insurance law to best understand how it impacts drivers. Below, we outline our recommended Michigan car insurance options to help you make the best decision for you and your family.

Recommended Michigan Car Insurance Options

We strongly urge consumers to purchase the following coverages:

Lifetime, Uncapped PIP Allowable Expense Benefit Coverage

We strongly urge people to pay a little extra on their premium and continue their current lifetime, uncapped allowable expense benefits coverage. Allowable expense benefits reimburse your medical expenses, pay for in-home attendant care, provide for home and transportation modifications according to your needs, and more.

Very High Liability Insurance Limits

In light of fact that all of us now have increased liability for a victim’s catastrophic medical expense, we urge consumers to purchase as much auto liability insurance coverage as possible. We suggest a minimum of $500,000 of auto liability coverage, plus an optional umbrella policy that will provide additional liability coverage beyond that amount.

Significant Uninsured and Underinsured Motorist Coverages

We strongly urge all consumers to purchase uninsured motorist coverage and underinsured motorist coverage in order to provide additional protection for themselves and their family if they become the victim of serious injury caused by the fault of another driver who has no insurance or inadequate insurance. If the at-fault driver is completely uninsured, and the victim has purchased uninsured motorist coverage, that coverage will stand in the shoes of the at-fault driver and provide compensation to the victim, up to the policy limits purchased, in the same way that would have been the case had the at-fault driver had insurance. If the at-fault driver has liability insurance coverage, but not in an amount to fully compensate the victim for the damages suffered, and the victim has purchased underinsured motorist coverage, that coverage will provide additional benefits, up to the policy limits purchased, for those types of damages that the victim could have recovered from the at-fault driver, had that driver been more fully insured. This underinsured motorist coverage is critically important today, given the low liability insurance limits that are purchased by many motorists.

Avoid Step-Down Policies

A few insurance companies in Michigan insert clauses in their insurance policies that provide “step-down coverage.” These policies should be avoided at all costs. These policies state that if the claimant is a relative of the insured person’s household, that claimant can recover only limited liability damages under the policy, which, in many situations, are far less than what total strangers would be entitled to recover under that same policy. Simply put, step-down clauses discriminate against family members of the insured person.

Avoid Managed Care Options

Due to the current uncertainty as to the details of managed care option policies and the probable limitations on the rights of patients to choose their medical providers, we recommend that consumers not purchase any managed care option.

Need for Prompt Legal Counsel Following a Crash

As of July 2020, accidents resulting in serious injury will become much more complicated than they ever were under the original law. If a victim has purchased limited coverage that is not enough to pay for their medical expenses, the victim must seriously consider promptly pursuing a tort liability claim against the at-fault driver to recoup some of the excess loss. Such liability claims will typically involve an analysis of “fault allocation,” which means that the victim will only be able to recover that portion of the victim’s excess medical expenses that corresponds to the percentage of fault allocated to the other driver.

Example of Fault Allocation

For example, if you are in an auto accident as the result of the other driver running a red light, but you were driving 10 miles above the posted speed limit, it is likely a jury would find both drivers to be partially at fault. Therefore, in a trial, the jury would listen to the specifics of the accident and allocate percentages of fault between you and the other driver. If the other driver’s act of running the red stoplight is deemed to be 75% of the cause for the accident, and your speeding is found to contribute to the collision at 25%, your excess medical expenses will only be reimbursed up to 75% of their total. So if you have outstanding medical expenses above your chosen capped policy limit, let’s say in the amount of $500,000, the other driver would only be responsible for 75% of that $500,000, or a total of $375,000.

These fault allocation issues can be complicated and will frequently require the attention of an experienced attorney. In addition, there will be disputed liability situations where both drivers incur excess medical expenses and are making a claim against one another for those uncompensated losses. These situations create complexities beyond the scope of this summary. Suffice it to say, however, that the new law will usher in an era of complicated questions that will require all victims to proceed with great caution and with a full understanding of their legal rights. One thing is clear: if there is any uncertainty, don’t go it alone.

For more information about our recommended car insurance options, you can read our full brochure “Making Smart Choices: a Summary Guide to the New Auto No-Fault Law” here.

If you’ve been in a car accident and need to know your legal rights, please contact our firm by calling 866.758.0031 or submitting an online contact form here.